THE CONDADO PLAZA HILTON, SAN JUAN, PUERTO RICO

With Over 182 Attendees, the 2019 Puerto Rico Rural Lending Investment Summit was a Huge Success!

The National Rural Lenders’ Roundtable (NRLR), the U.S. Department of Agriculture (USDA) Rural Development and the U.S. Small Business Administration (SBA) partnered for the 2019 Puerto Rico Lending Investment Summit that was held March 7 and 8, 2019 in San Juan, Puerto Rico at the Condado Plaza Hilton Hotel. The summit marked the premier event joining lenders and stakeholders in the USDA and SBA guaranteed-lending community with local and federal officials in a concerted effort to provide Puerto Rico’s rural communities with access to capital and bolster Puerto Rico’s economic recovery in the aftermath of Hurricanes Irma and Maria.

Invited guest speakers for the summit include Mrs. Bette Brand, USDA Rural Business-Cooperative Service Administrator and Rural Utilities Service Acting Administrator; Mr. Joseph Ben Israel, USDA Rural Development Assistant Administrator for Community Facility Programs; Mrs. Edna Primrose, USDA Rural Development Assistant Administrator for Water and Environmental Programs; Mr. Steven Bulger, Small Business Administration Region II Administrator; the Hon. Manuel Laboy, Puerto Rico Secretary of Economic Development and Commerce; the Hon. Fernando Gil, Puerto Rico Secretary of Housing; Mr. Gerardo Portela, Chief Investment Officer of Puerto Rico; Mr. Omar Marrero, Executive Director of the Puerto Rico Public-Private Partnerships Authority and the Central Office for Recovery, Reconstruction, and Resiliency, among others.

The summit was a great success as it provided information covering essential community facilities such as hospitals, medical clinics and nursing homes, educational services, utility services, and local foods systems, among others.

The summit presented a great opportunity for lenders, investors and entrepreneurs to join forces and promote the launch of new businesses and the creation of new jobs that will drive economic development for Puerto Rico’s rural communities. It was a critical juncture to make history and advance Puerto Rico’s recovery and reconstruction efforts after the destruction caused by hurricanes Irma and María.

The National Rural Lenders’ Roundtable was proud to partner with stakeholders to share successes, goals and ideas for a common mission to increase the flow of capital to Puerto Rico. We look forward to the days ahead to provide access to aapital for businesses and communities in advancing rural prosperity.

WWW.NRLRT.COM

Bette Brand, USDA Administrator, Rural Business-Cooperative Service, Discusses the Farm Bill & OneRD

Bette Brand, Administrator, Rural Business Services, USDA gave attendees an excellent overview of the Farm Bill that was passed by Congress in December and signed bythe Administration. Of the 80 actions required, 40 fall under Rural Development. She touted the OneRD Guaranteed Loan Program that would standardize regulations for the four Rural Development programs — Business and Industry, Rural Energy, Community Facilities and Water and Waste.

NRLR Discusses Advancing Rural Prosperity Through Various USDA Loan Programs

Thomas Kimsey (Thomas USAF Group) moderated a panel discussion with Bruce Lammers (Byline Bank), Trae Dorough (Touchmark National Bank) and Jordan Blanchard (Live Oak Bank) on Government Guaranteed Lending. The group discussed recommendations sought by lenders for Rural Business Services loan programs. The goal? Make the processing more streamlined to allow lenders to get more capital to Rural American entrepreneurs.

Administrator Bette Brand Discusses Advancing Rural Prosperity

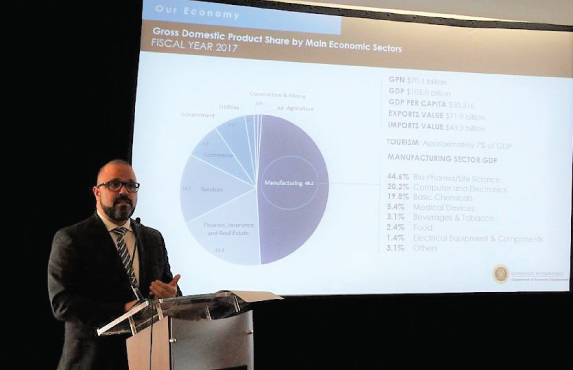

Ninety-six percent of Puerto Rico is an opportunity zone area. Opportunity zones give excellent tax savings for investors, and provide needed capital for underserved markets, especially Puerto Rico. Rodrigo Masses, Chairman of the Puerto Rico Manufacturers Association, moderated the panel discussion. Pictured left to right: Gerardo Portela (Chief Investment Officer of Puerto Rico), Jorge Salichs (Carrasquillo Law Group), Francisco Rodriguez (Birling Capital Advisors) and Kenneth Rivera (FVP alindez & Puerto Rico Chamber of Commerce)

Puerto Rico is An Opportunity Zone

With ninety registered attendees, the 2018 Annual National Rural Lenders’ Roundtable in DC had record attendance, despite the shutdown of the government due to the passing of President George H.W. Bush.

WWW.NRLRT.COM

USDA & SBA Join Forces to Help Businesses in Puerto Rico

“This is the greatest disaster in U.S. history. SBA has funded 56,000 disaster loans totaling $2 Billion. We have 100 disaster team members deployed,” said Steve Bulger, Region II Administrator, SBA. “We have opportunity zones for the savvy investor who wants to serve as a catalyst for economic growth. SBA’s commitment is to help Puerto Rico move forward and recover from the hurricanes and improve the small business ecosystem.”

The Economic & Disaster Plan for Puerto Rico

An update of the rebuilding of Puerto Rico’s infrastructure was presented by Omar Marrero, Executive Director of the Puerto Rico Public-Private Partnerships Authority. The Government of Puerto Rico views the recovery effort as an opportunity to transform the Island by implementing solutions that are resilient, cost-effective and forwardlooking, harness innovative thinking and best practices to revitalize economic growth.

Secretary Fernando Gil on Recovery Funds Coming to Puerto Rico

Fernando Gil, Secretary of Housing, Puerto Rico, discussed recovery funds coming to Puerto Rico. The statistics are sobering — 100% of the energy and telecommunications grids were damaged or destroyed. $547 million was lost in tourism revenue. Employment declined to 4.3%. 724,000 homes were damaged or destroyed. The CDBGDR Action Plan is for an estimated $19.9 Billion and is on track to meet the urgent needs of housing, planning, economic recovery and infrastructure.

The Mission of USDA RBS: Provide Access to Capital in Rural Areas

Mark Brodziski, Deputy Administrator, Rural Business-Cooperative Service, USDA, discussed the agency’s mission driven actions, specifically investing in financial resources and providing technical assistance to businesses located in rural communities. The goal is to establish strategic alliances and partnerships that leverage public, private and cooperative resources to create jobs and stimulate rural economic activity. He stressed the need to increase capital for rural America and grow RBS’s investment portfolio of $216 Billion.

WWW.NRLRT.COM